Additional tax on super balances over $3m

Overview

The Federal Government’s proposal to raise additional tax from individuals with larger superannuation balances above $3m has generated significant media attention. As usual the devil is in the detail, of which there is little in the Treasury’s Fact Sheet accompanying the announcement, although further information is expected after a period of consultation in the lead up to the May Budget.

So far, it is evident that there are controversial aspects – in particular the taxation of unrealised gains. Be that as it may, it is also apparent that the adverse tax consequences (of an additional 15% tax on notional “earnings” relating to a member’s superannuation balances over $3m) may not be as severe as the headlines initially purport.

For example, APW’s preliminary modelling indicates that the effective tax rate for most people with superannuation balances above $3m threshold would be less than the 30% rate indicated by federal Treasurer, Jim Chalmers.

Put simply, the merit of investing via the preferential tax structure of superannuation remains compelling.

Further, the proposals are not slated to commence until the 2025/26 year following the next Federal election. This will allow considerable time for thoughtful planning and implementation of any countermeasures (if required) once further details about the final form of the new legislation become known. Importantly, it is most likely premature to make any changes at this time.

Finally, it should be noted that any additional tax will not become due and payable before the 2026/27 financial year, at the earliest.

How it works

The additional tax is calculated by determining the growth in an individual’s Total Superannuation Balance (TSB) between the start and end of a financial year, adjusted for any contributions and/or withdrawals during the period. A flat 15% tax is then applied to a proportion of the earnings corresponding to the balance above $3 million.

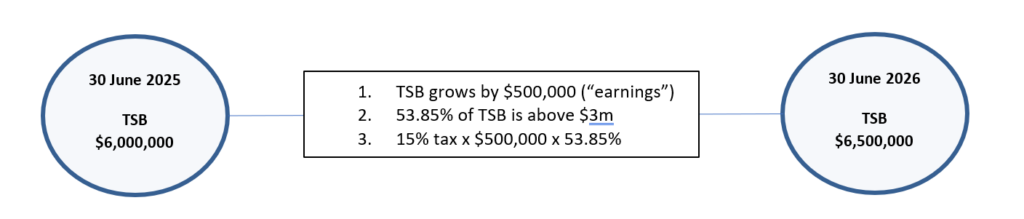

By way of simple example:

- A $6m TSB grows to $6.5m TSB and so will have earned $500,000.

- The proportion of earnings corresponding to the balance above $3m is 53.85%

i.e. [$6.5m – $3m] / $6.5m

- The tax liability will be $40,388*

i.e. $500,000 x 53.85% x15%

* represents ~8% of earnings or 0.62% of the closing member account balance

The additional tax payable each year will be levied against the individual who will then have the choice of paying the tax personally, or alternatively making an election to pay it from their superannuation account.

Other Aspects

The Government has flagged the intention for defined benefit superannuation entitlements to be taxed in a similar manner, but detail has yet to be provided on this.

For the time being, the proportion of Australians with superannuation balances more than $3 million is relatively low (<0.5% according to the Federal Government). However, with growth in superannuation balances over time, the lack of legislated indexation of the threshold and the potential inheritance of a deceased spouse’s superannuation, more and more Australians will be impacted by this proposed change in the years ahead.

Restructuring Strategies

For those affected, appropriate planning will need to occur if these proposed measures are enacted. In due course, there are various options to tax effectively restructure the affairs of those with larger superannuation balances which the APW Partners team will consider on a case-by-case basis. Some of the options include:

- Investing monies via a discretionary trust with a corporate beneficiary

- Investing monies via an insurance bond structure

- Bringing forward intergenerational wealth planning via assisting children with superannuation contributions and/or property purchases

The cost and impact of restructuring superannuation will need to be considered as well as other potential benefits aside from a concessional rate of tax on earnings, such as estate planning aspects.

To reiterate, before making any changes it is important to remember that the new tax measure is a proposal only and not yet law. Treasury is consulting on implementation and the details may change.

APW Partners will continue to monitor the proposals and work with clients directly to determine their best course of action.