Do Sharemarket Annual Returns behave like Long Term Average Returns?

When considering investing into the share market, investors need to ensure they understand what is meant by ‘long term average returns’. Whilst not intended to be misleading, the term ‘average returns’ can potentially provide investors with a false sense of security, setting unrealistic – short term expectations.

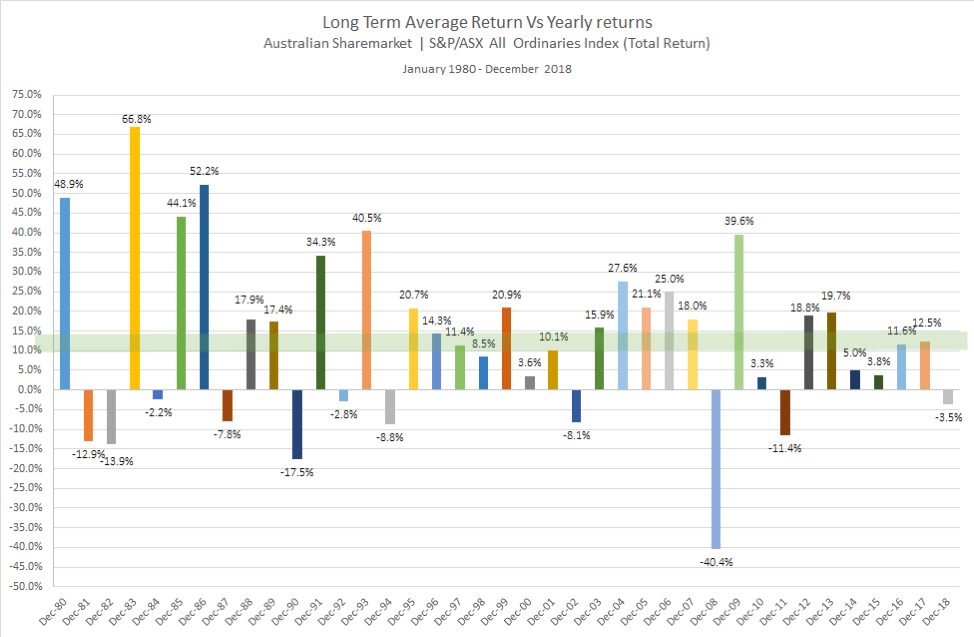

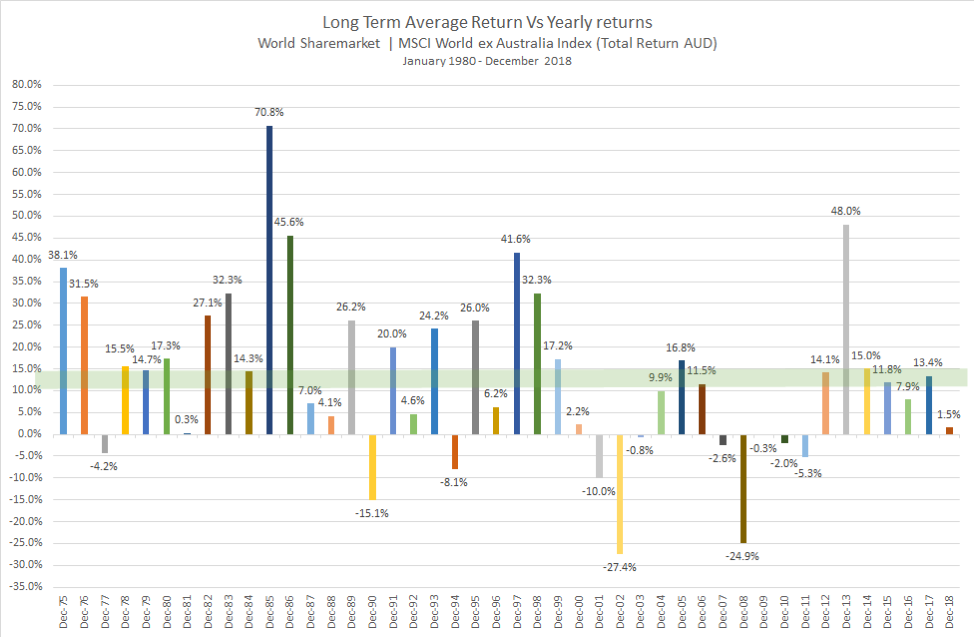

Consider for example, the historical average return over rolling 12 month periods (eg Jan – Dec 1980, Feb 80 – Jan 81…) in both Australian and global share markets over the past 40 – 45 years;

- Australian share market average return = 12.20% 1

- Global share market average return = 12.81% 2

Whilst this historical period reflects very healthy long term annual returns, it is also the case that short-term results varied widely, and in any given period – share returns were positive, negative, and flat.

With this level of variability in mind it is helpful to ask the question – How often have share market annual returns actually aligned with long-term average returns?

Consider Exhibit 1 and 2 below, which show calendar year returns for the share market in both Australia and overseas (ex-Australia) since January 1980 to December 2018.

The light green line running left to right of the chart highlights the historical average returns plus or minus 2 percentage points. In the Australian context, only five of the past 39 calendar years had returns that fell within the range and globally only seven of the past 43 calendar years coincided with the long term average.

In most years, the market index’s return was outside of the range – often above or below by a significant margin – with no obvious pattern from year to year. For investors, this data merely highlights the importance of looking beyond average returns and being aware of the range of potential outcomes.

Exhibit 1 (Australian Share market)

Exhibit 2 (World ex-Australia Share market)

Tuning In To Different Frequencies

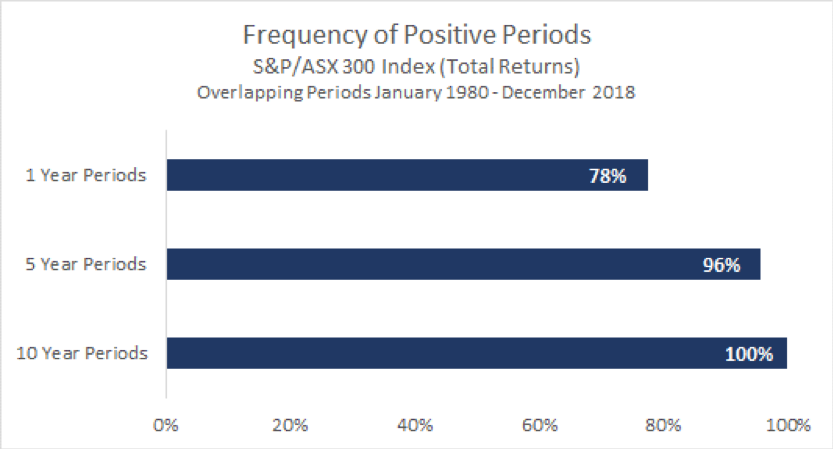

Despite the year-to-year volatility, investors can potentially increase their chances of having a positive outcome by maintaining a long-term focus. Exhibit 3 documents the historical frequency of positive returns over rolling periods of one, five, and 10 years in the Australian market. The data show that, while positive performance is never assured, investors’ odds improve over longer time horizons.

Exhibit 3

Conclusion

While some investors might find it easy to stay the course in years with above average returns, periods of disappointing results may test an investor’s confidence in equity markets. Being aware of the range of potential outcomes can help investors remain disciplined, which in the long term can increase the odds of a successful investment experience.

What can help investors endure the ups and downs?

While there is no silver bullet, understanding how markets work and trusting market prices are good starting points. An asset allocation that aligns with personal risk tolerances and investment goals is also valuable. By thoughtfully considering these and other issues, investors may be better prepared to stay focused on their long-term goals during different market environments.

1 As measured by the S&P/ASX S&P/ASX All Ordinaries Index (Total Return) from January 1980 – April 2019.

2 As measured by the MSCI World ex Australia Index (Total Return) (Unhedged) from January 1980 – April 2019.

Important note – there is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Investors should talk to their financial adviser prior to making any investment decision. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit. All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.