Global Markets & the Reaction to Coronavirus (COVID-19)

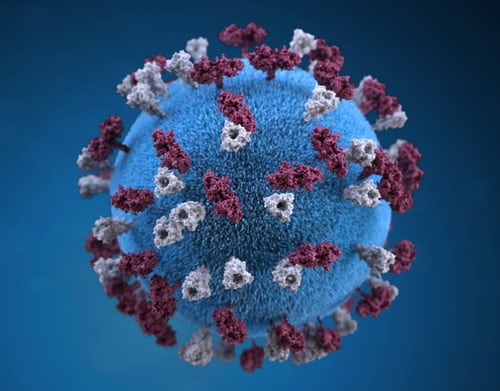

Investment markets worldwide have declined sharply this past week as investors come to terms with the potential implications of the ongoing spread of coronavirus disease (COVID-19).

Whilst our focus in this document is more attuned to the economic and financial consequences, we are very mindful that COVID-19 is first and foremost a humanitarian challenge and there is still much to be done to contain its spread as well as to support victims and families and develop a vaccine.

So far we know the disease is highly contagious, but its transmission mechanism is less well-understood. The disease seems to have an overall mortality rate much less than other well-known epidemics, with a preliminary mortality rate of 2-3% (significantly lower incidence outside of China). The rates of fatality are anticipated to be lower and will probably never be known for certain – in any event, the current estimate compares relatively favourably to a 10% mortality rate for the SARS outbreak in 2002-03, and a 50% rate for various Ebola outbreaks arising in part from weaker health systems.

Over the last week or so, the Australian Sharemarket S&P/ASX All Ordinaries Index has reacted, falling by approximately -10%, with the MSCI World ex Australia Index (Unhedged + AUD Hedged) having declined by -8% and -10% over the corresponding period, respectively. Whilst there is no denying these falls are significant – it is important to put them in context to the substantial increase in value achieved through the calendar year of 2019 of +24% (Australia) and +27% (Global Developed Markets) and the continued upward trajectory through January and much of February this year.

Accepting that no-one can credibly predict how events will unfold in coming months, it is instructive to consider the impact of previous epidemics^ on global equity market total returns (including dividends) and observe that share markets are remarkably resilient to adverse shocks.

The table below references the Australian and global share market returns in the aftermath of 8 of the most significant epidemics over the past 2 decades, from an Australian investors’ perspective:

^ The World Health Organisation has not yet declared the COVID-19 as a pandemic, but has elevated its assessment of the virus to the highest risk level. Even though it has now spread to over 70 countries the incidence of infection and fatality outside of China is still very low.

Where to from here for long term investors?

Whilst we recognise that each health threat needs to be considered on its merit, we believe it is prudent to be cautious in making significant change to long term investment strategies. In particular, selling growth assets (shares and property) only with the intention to ultimately reinvest at a later date (when the dust has settled), is fraught with a potentially greater risk of permanent capital loss.

If anything, the recent correction (>10% fall) in share markets may present an opportunity to rebalance portfolios, taking advantage of the short term increase in bonds and the corresponding reduction of share prices. Again, there is no need to rush into this decision and the merits of any change need to always be considered in full light of any tax and transaction costs.

For now, the recent spread of the disease into South Korea, Italy, and Iran demonstrates that we are likely to be dealing with coronavirus outbreaks for months to come. During this next period of time there could be further falls in equity markets; exacerbated by institutional sellers that have a clear mandate to trade, investors with strategies misaligned to their real risk tolerance and many investors that will simply react to the heightened level of uncertainty reported in the media and make the mistake of focussing on a short term horizon. The US Federal Reserve has signalled that it is closely monitoring the economic impacts of COVID-19 and is prepared to lower interest rates to stimulate growth. In Australia the Reserve Bank has also implemented a further rate cut by 0.25% to an historic low of 0.50%, which the major banks have already committed to pass on to mortgage borrowers in full. Furthermore, Prime Minister Morrison has pre-empted that we should anticipate targeted measures to stimulate business investment and consumer confidence in the near term (abandoning the planned return to Budget surplus this year).

What should you do?

Most importantly, we do not see the need for panic, or any dramatic / immediate change to the asset allocation of portfolios. Keep in mind that portfolios have been designed and structured with a long-term horizon in mind, allowing for short term volatility and systemic shocks to occur from time to time. Portfolios are extremely broadly diversified, with several thousand securities, properties and bonds.

What will APW do?

It’s important to remember that when equities fall in value, bonds typically hold their value and often increase – reducing the overall volatility of the portfolio. This has certainly been the case for portfolios over the past week.

In cases where re-balancing makes sense, some of the surplus cash and bonds may be sold (with an expected small gain) to acquire more of the shares (at the lower prices) – to restore the preferred long term asset allocation. In any event the rebalance may apply to a relatively small proportion of the portfolio at this stage (not likely to be more than 2-3%).

In any event, we will continue to monitor the global economic situation and keep you informed of our observations and insights.