Gold – What is its value as an Inflation Hedge?

In the late 16th century William Shakespeare wrote in the Merchant of Venice, “All that glisters is not gold” and thus warned that not everything that looks precious is necessarily so upon closer inspection.

To this cautionary observation starry eyed investors might also note, – that gold glisters is not all. Indeed, there is much to consider when trying to appraise the value of the precious metal from an investor’s perspective and determine what role (if any) it should play in a well-diversified portfolio.

There are many aspects to be considered in this process, including;

- What proportion of a portfolio should be allocated to gold?

- What other investment(s) to hold less of (and by how much) to fund the gold purchase?

- What assumptions should be made about future inflation, interest rates, economic growth, geo-political risk, … etc?

- What are the consequence(s) for capital growth and capital protection when, in an uncertain world, well-reasoned assumptions are inevitably found to be inaccurate?

The World Gold Council states that, “the gold market is large, global, and highly liquid and estimates that physical gold holdings by investors and central banks are worth approximately $US5.1 trillion. To put this into perspective, according to Statista – a research/data firm, the global sharemarket is valued at over $US100 trillion. Further, the global bond market is more than three times larger than the global sharemarket.

Though gold is dwarfed by shares and bonds, investors often turn to gold in periods of uncertainty – fearing externalities such as the ravages of high inflation, geo-political upheaval, and fiscal / monetary policy settings that create intended or incidental currency debasement.

A such, gold is sometimes promoted to investors as a means of protecting wealth during times of rising prices. Although there is support for this assertion in some instances, history also evidences the significant challenges of acquiring and holding gold to offset the impact of inflation as a year-by-year proposition.

Global investment research / asset management firm – Verdad, states “gold seems to have done well when stocks and bonds have performed poorly, especially in inflationary environments. However, it has mediocre returns and extreme capital drawdowns historically.” This significantly limits the merit of making a meaningful addition of gold to a portfolio in the absence of a reliable crystal ball to the future.

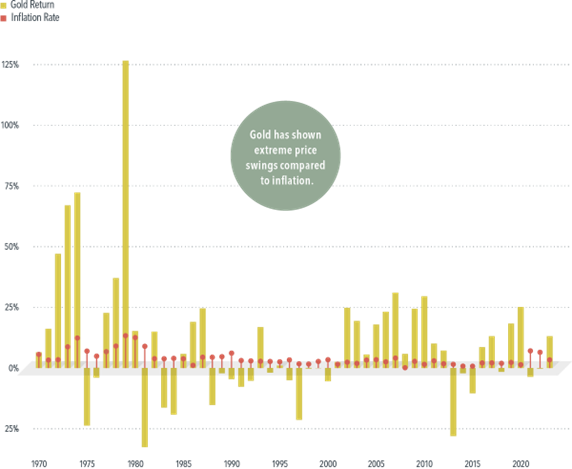

Since the early 1970’s (about the time that the post WWII Bretton Woods gold standard was abandoned by the International Monetary Fund), gold has often experienced large price fluctuations relative to changes in the level of annual inflation, as Chart #1 shows.

Importantly, an effective inflation-hedging tool should have return volatility that is broadly consistent with changes in consumer prices, not a multiple of them.

Source: Dimensional Fund Advisors

A significant hurdle for those who might be contemplating investing into gold is that it doesn’t generate any income. In high inflation periods, (which typically coincide with higher interest rates), this is a major drawback. In addition, gold bullion costs money to store securely, transport and insure.

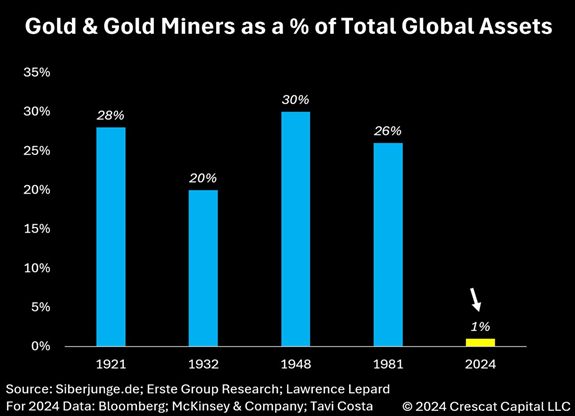

It is interesting to observe the significant decline in gold’s share of investor wealth over the last quarter century using a benchmark globally diversified investment portfolio, as shown in Chart #2 below.

There are myriad possible explanations for this including, the headwinds arising from a secular fall in interest rates and inflation over much of this period (which undermines gold’s utility), the evolution of capital markets and expansion in other investment opportunities (accelerated by rapid technological advances), a relatively benign period of geo-political risk at the end of the Cold War (albeit truncated by events in recent years), and the ongoing costs of ownership.

Although gold may have lost much of its lustre in recent decades (notwithstanding rising prices in recent years), this is not to suggest that it won’t shine again at certain periods in the years ahead.

However, it is prudent to observe that it is a long climb back to a position of relevance in the world allocation portfolio from gold’s current levels, and a tailwind confluence of favourable circumstances would be needed for this to seem plausible.