Turbulence Ahead

After a strong start to 2024, equity markets are now facing magnified risks that include persistent inflation, weaker economic data, increased tensions in the Middle East and escalating US / China trade wars. As such, investors should note that there may be some turbulence ahead in financial markets as they navigate the risks and adjust to potentially ‘higher for longer’ interest rates.

Central Banks exhibited confidence towards the end of last year that enough had probably been done to tame inflation, (after the fastest and largest rate hiking cycle on record), and that the next move in rates would be downward. However, so far this year we have seen that expectations about the timing and magnitude of those rate cuts has been far more volatile.

At the start of this year a common view amongst many economic commentators was that the Reserve Bank (RBA) would cut the 4.35% official cash rate by 0.25% on three separate occasions in 2024, and begin as early as March.

By the end of March it may have looked to some like clear blue skies ahead, – that interest rates and inflation were moderating to normal levels, economic growth was forecast to improve, and unemployment remained low. There appeared to be no obvious risks on the horizon (although ongoing geopolitical tensions remained on the radar).

But of course, in financial markets the potential for the unexpected is always just around the corner to disorient the unwary and unprepared. Indeed, once the official results were in for the March quarter, the economic data in the US and Australia indicated that inflation was not coming down as fast as markets had anticipated, or that Central Banks would have liked.

By mid-April data from both the US and Australia had inflation printing higher than expectations – strengthening the case for delayed rate cuts and raising fears of potential rate increases should inflation continue to stick. Consequently, expectations changed to reflect perhaps only a single 0.25% cut by the RBA, – sometime in the latter half of the year.

In the US the Federal Open Market Committee opted at their May 1st meeting to maintain the Fed funds interest rate at the current target range between 5.25% and 5.50%. While the Federal Reserve signaled fresh concerns about inflation, the Chair indicated that it was unlikely that the Fed’s next move would be to raise interest rates, stating they would need to see persuasive evidence that policy is not currently tight enough to bring inflation back toward its 2% target.

Market commentators have moved from a ‘hard landing’ scenario for the Australian and US economies only a year ago, to some form of ‘soft landing’ earlier this year, and now a possible ‘no landing’ scenario, where higher interest rates could be in a holding pattern until inflation is brought back to target.

Meanwhile, global equity markets have remained broadly positive, and in some instances have gone on to reach new highs. Corporate earnings in Australia have been solid, and even if rate cuts looked like being further down the track this would still be consistent with inflation coming down, – and the economy was generally in good shape.

The Australian stock market returned a healthy +5.3% for the March quarter, while global markets returned a stunning +14% in Australian dollar terms, led by the US market – and in particular the big technology companies that were investing heavily into future applications of Artificial Intelligence (AI).

Although the data indicates that rates could stay ‘higher for longer’, financial market continue to believe that Central Banks will be able to deliver a minor miracle and beat inflation without a painful rise in unemployment. It would be prudent to defer judgement on this as slaying the inflation dragon is no easy feat and may take some time yet.

Over the past week or so many commentators have expressed disappointment that the Federal Budget will be inflationary and further delay RBA interest rate cuts here in Australia.

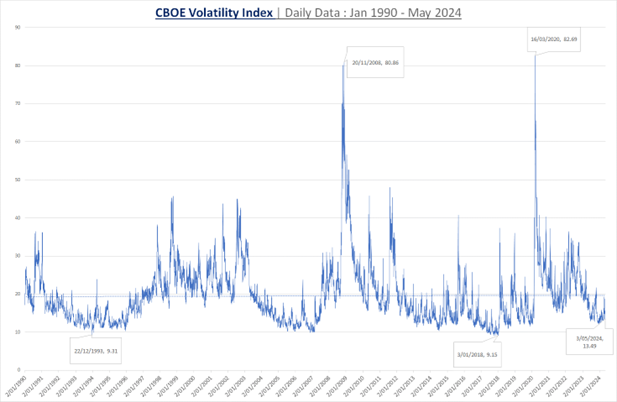

In the US a gauge of the turbulence in markets can be seen in the Volatility Index, or the VIX, which represents the implied volatility of the S&P 500 Index. The VIX is sometimes referred to as the “fear index”, and one can see in the chart below that in recent months volatility has tended towards the lower levels experienced over recent decades.

The last few weeks reminds investors that turbulence in markets – whilst never pleasant – is a part of the investment journey. We don’t expect the recent volatility to be the last we will see this year as clearly risks and uncertainties remain, – particularly regarding geopolitics and the level of interest rates.

As such, investors should note the possibility of continuing turbulence ahead in financial markets as they navigate the risks and adjust to potentially ‘higher for longer’ interest rates.