ESG Investing – The importance of discernment

Australians’ interest in investing with an Environmental, Social and Governance (ESG) mindset has advanced significantly in recent years, but there is still much to learn about these approaches.

Questions about the measurement and weighting of ESG variables, the reliability of ratings systems, the transparency of outcomes, and ongoing issues around cost and performance all pose challenges that warrant detailed and systematic consideration.

APW’s clients know the high bar we set to ensure the investment strategies chosen are appropriate for their risk appetites, circumstances and investment goals. A similar level of due diligence is appropriate when incorporating ESG considerations which have rapidly migrated from the periphery to being integral when assessing investment risk.

With that in mind, we wanted to update you on recent developments in ESG investing and the issues we have been looking at to ensure that the investment solutions being offered are methodologically sound, true-to-label and cost-effective.

ESG by the Numbers

First, some numbers to contemplate.

According to the Morningstar Global Sustainable Funds Flow Report, global fund assets surged +19% in the first quarter of 2021 to almost $US2 trillion. Net inflows reached +$183.3 billion, the fourth straight quarter of all-time highs.

Europe accounted for the vast bulk of investor inflows (79.2%), followed by the US (11.6%), Asia ex-Japan (4.2%) and Australia and New Zealand (0.6%). For Australia and NZ, that translates into $21.2 billion in assets, across 129 investment funds.

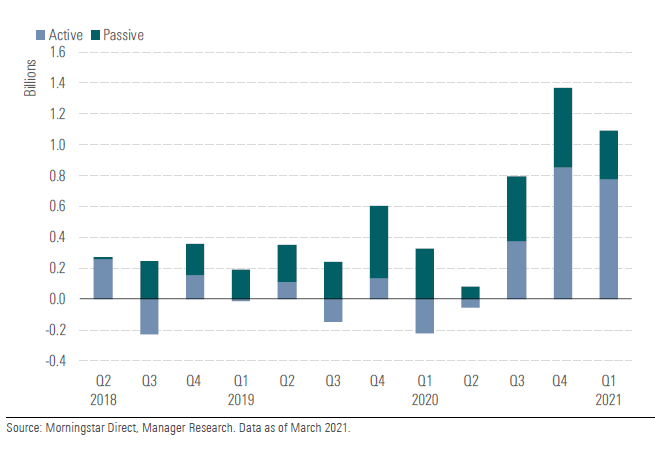

Locally, a recent trend deviation has been the rapid rise in actively traded ESG strategies, which are widely documented as being more expensive to implement and have produced less reliable long term outcomes than those recommended by APW. The chart below shows 71% of first quarter sustainable fund flows were directed to strategies constructed in this way according to the classification methodology used by Morningstar Research.

Whilst the overall flow of funds into ESG is undoubtedly representative of growing investor demand, it is critical for investors to note that there are often considerably higher costs charged by fund managers for implementing ESG strategies.

Methodology and Transparency

Alongside cost, the rush to market by many investment fund managers to capitalise on the business opportunity created by the increasing appetite for ESG investing is necessitating particular due diligence around investment methodology and transparency.

On this score, regulators are also paying increasing attention. Earlier this year, the US Securities and Exchange Commission (SEC) warned investors to exercise discretion in choosing ESG funds due to growing disparity in methodologies and measurement.

Some ESG filters may be highly subjective, the regulator warned. With little uniformity in definition or application across Funds, it is important that investors be aware that weight to ES and G issues can occur for very different reasons. Equally, third party ratings / scores (such as that provided by Morningstar), can also weight these issues in many varied ways, making it difficult to interpret with confidence.

Both the SEC and its European equivalent have warned of the risks of ‘greenwashing’ (issuing unsubstantiated claims about sustainability). New rules in the EU will require people marketing ESG products to disclose how sustainable they really are in a much more robust manner using objective measurement criteria.

In a bid to help financial intermediaries, index providers and other firms have been coming up with new ratings systems. The trouble is these systems have been shown to be highly subjective and often diverge significantly in what they assess, how they measure the variables and how they set the weights on the ES and G pillars which serve to underpin the portfolio construction

In their 2020 report “ESG Investing: Practices, Progress and Challenges” the Organisation of Economic Cooperation and Development (OECD) compared ESG ratings from five different providers applied to 10 major US companies across several major industries. It found little consistency in the ratings, reflecting differences in methodology.

“These differences raise important questions about reliance on any one rating to make investment decisions, including for structuring investment portfolios that are intended to have a tilt toward higher ESG scores,” the OECD report found..

At home, the Australian Securities and Investments Commission (ASIC) is working with international regulators on an initiative to impose greater transparency and consistency around the rollout of ESG funds. Background on this initiative and the implications for Australian disclosure are available in this Norton Rose Fulbright paper.

Separately on the transparency front, ASIC this year gave notice to directors of ASX-listed companies about managing climate risk and disclosures. Also, the Australian Prudential Regulation Authority recently issued a draft prudential practice guide to help financial institutions better understand and manage climate risks.

APW’s Approach

Given the fast-moving and rapidly evolving nature of ESG product development, cost structures, measurement methods and regulation, APW’s approach consistently has been to start with a close assessment of client needs, values, goals and priorities.

In weighing the transparency of competing offerings and in judging the risk-and-return characteristics of ESG solutions, our first reference is what is important to each client and how these values fit into their broader goals.

Some clients are concerned about the risks around climate change and related environmental issues like deforestation, water use and land management. Others are focused more on social issues beyond the traditional tobacco and alcohol screens to such areas as nuclear weapons systems, cluster munitions and child labour.

We seek to connect those client preferences to investment strategies that are most likely to meet their specific goals and aspirations. We do this while managing expectations about what can be achieved within the broad principles of low cost, diversification and a focus on the long-term drivers of higher expected return.

None of this can be done without a sound grasp of the details of sustainable investing, details frequently overlooked in an industry where some participants are merely seeking to ‘cash in’ on the genuine interest among investors in ESG issues.

Broader Issues

Aside from sustainability and the traditional social issues, companies’ broader stakeholder responsibilities are increasingly being emphasised in such areas as cultural heritage, workplace justice, and diversity and inclusion.

Two years ago, the US Business Roundtable – an association of leading company CEOs – committed to moving away from an exclusive focus on shareholders to consider all stakeholders – including customers, employees, suppliers and communities.

These new broader responsibilities were highlighted vividly by Rio Tinto. In 2018, Rio became the first resource major to go ‘coal-free’ – a big tick for the ‘E’ equation in ESG. But two years later, its record on cultural heritage management was tarnished by news it had destroyed 46,000-year-old rock shelters at Juukan Gorge in Western Australia

That scandal had significant consequences for Rio Tinto, leading to the resignation of the CEO and two deputies, as well as a moratorium on mining around the gorge.

For investors, cases like Rio Tinto can prompt questions about whether to accept the changes as a sign of good faith or continue to exclude the company altogether.

It is here that trade-offs can emerge between high conviction and diversification. For instance, the complete exclusion of materials and energy stocks within the Australian market can lead to portfolios that look significantly different to the overall market and exhibit a much higher degree of volatility.

While these are all valid issues, APW’s approach is to focus on the key outcomes and ask ourselves these questions:

- Firstly, are we building portfolios that significantly cut the client’s carbon footprint beyond what it would be without a sustainability filter? And can we show that?

- Secondly, are we excluding companies associated with undesirable social issues such as child labour, weapons systems, factory farming etc?

- Thirdly, are we investing in organisations that emphasise strong stewardship and a focus on governance for all stakeholders? If companies are not walking the talk, what leverage do we have?

- Fourthly, are we positioning the portfolio in such a way that maximises the opportunity for each client to reach their investment goals while maintaining low costs and without taking any more risk than is necessary?

- Finally, are we continuing to review a rapidly changing landscape for new developments in ESG methodology, measurement, cost and regulation?

Our view is we are achieving all of these goals, but that does not mean our job is done. We have shown that the market is developing rapidly so that the need for us to stay across developments has never been more apparent.

Helping APW on this front is our standing as a signatory to the UN Principles for Responsible Investment (UNPRI), which provides a useful framework for integrating ESG issues in the investment process to better manage risks and improve returns.

ESG No Longer a Fringe Issue

Of course, how individuals choose to invest is entirely up to them. Some may not see any need to take account of environmental or social issues in their investment plan. But is important that we have that conversation with clients and explain the issues to them so that they can make fully informed choices.

Once our clients decide they want to incorporate their wider values within their wealth management plan – and we find that most do – we have helped them articulate their objectives, translated the jargon, undertaken the due diligence on the available investment offerings and tailored those solutions to client needs without exposing them to any more risk or cost than is necessary.

Most of all, we want to keep clients up to date on the rapid changes in how ESG is being managed and measured globally, how regulators are viewing the issue and how this plays out in terms of investment costs and outcomes.

In short, we are minding the details.

Associated Reading:

‘Environmental, Social and Governance (ESG) Funds – Investor Bulletin’ U.S Securities and Exchange Commission, 2021

‘EU prepares to turn the screw on asset managers over greenwashing’, Jessop & Abnett, Reuters, 2021

https://www.reuters.com/article/us-europe-regulations-finance-focus-idINKBN2B11LM

‘Greenwashing: International initiatives taken to address the issue, coming to Australia?’ J. Ireland, Norton Rose Fulbright, 2021

‘Managing client risk for directors’, Commissioner C Armour, ASIC, 2021

https://asic.gov.au/about-asic/news-centre/articles/managing-climate-risk-for-directors/

‘APRA releases guidance on managing the financial risks of climate change’, APRA, 2021

‘Business Roundtable Redefines the Purpose of a Corporation to Promote ‘An Economy That Serves All Americans’, Business Roundtable, 2019