The impact of Geopolitical turmoil on investment Markets

When you think of all the people in the cities of the world who could vanish in a moment

Say it isn’t true

Jackson Browne

Many historians and linguists attribute the etymology of “Ukraine” as deriving from the Slavic ‘ukraina’ – meaning borderlands. Sadly, this seems all to apt given the tragic events in recent weeks escalating into a horrific war between the opposing factions.

For Ukraine, it has literally and figuratively become the border between Putin’s tyrannical autocracy that is modern day Russia, and the liberal democratic, rules based global order expounded under US hegemony, which includes the geographically proximate member countries of NATO.

It has been said that truth is the first casualty of war. Unfortunately, the unavoidable truth is that once again the humanitarian, economic and financial market consequences arising from Europe’s most significant military conflict since WWII are already proving to be tumultuous and far reaching.

With the benefit of hindsight, more obvious conclusions can now be drawn about the true intent of the Putin regime, however, it has not been as simple as to have deduced that Putin’s actions were entirely predictable (much less justifiable) nor that the current situation in Ukraine was inevitable. Life, as we know is much more complicated than this, and often riddled with unexpected outcomes.

In very broad terms, it is the unexpected elements in life that create the greatest anxiety and discomfort in the short term. It is however critical to recognize that it is our response to these unexpected outcomes that defines our lived experience over the longer term.

To paraphrase Professor Ken French (Tuck School of Business, Dartmouth College https://mba.tuck.dartmouth.edu/pages/faculty/ken.french) in a recent presentation to our team on his decades of learnings from studying financial markets, -‘…. we can only ever know how the unexpected outcomes differ from the expected outcomes by observing the actual outcomes after the fact…’.

The breadth and speed at which governments, global organisations and companies across the Western world have both collectively and unilaterally imposed economic and financial sanctions in condemnation of Russia’s warmongering is breathtaking. In scarcely a week Russia has gone from representing around 3% of the global economy to becoming practically uninvestable.

The swift and near universal criticism by the global jury (including Russia’s own citizens) has been expedited by the interconnectedness of the world’s banking systems, trade channels and social media platforms. The zeitgeist is unequivocal – the Russian state is economically and morally bankrupt.

With a sense of increasing global geopolitical tensions, many APW clients have asked whether a link exists between such historical geopolitical events and subsequent financial market performance.

With this in mind, it is worth highlighting that in so far as APW client portfolios are concerned, the exposure to Russian equities has always been consciously negligible (ranging between 0.1% – 0.2%), with zero exposure to Russian government or corporate bonds.

Whilst the occurrence of historical crises has been highly unpredictable, the financial market outcomes after a period of time have generally demonstrated a remarkable degree of consistency.

Most often, post the initial news, markets react negatively with varying degrees of sell-offs occurring. Such periods of negative returns are normally short-lived and investment returns over the following 6 – 12 month periods largely realign with long-term average returns.

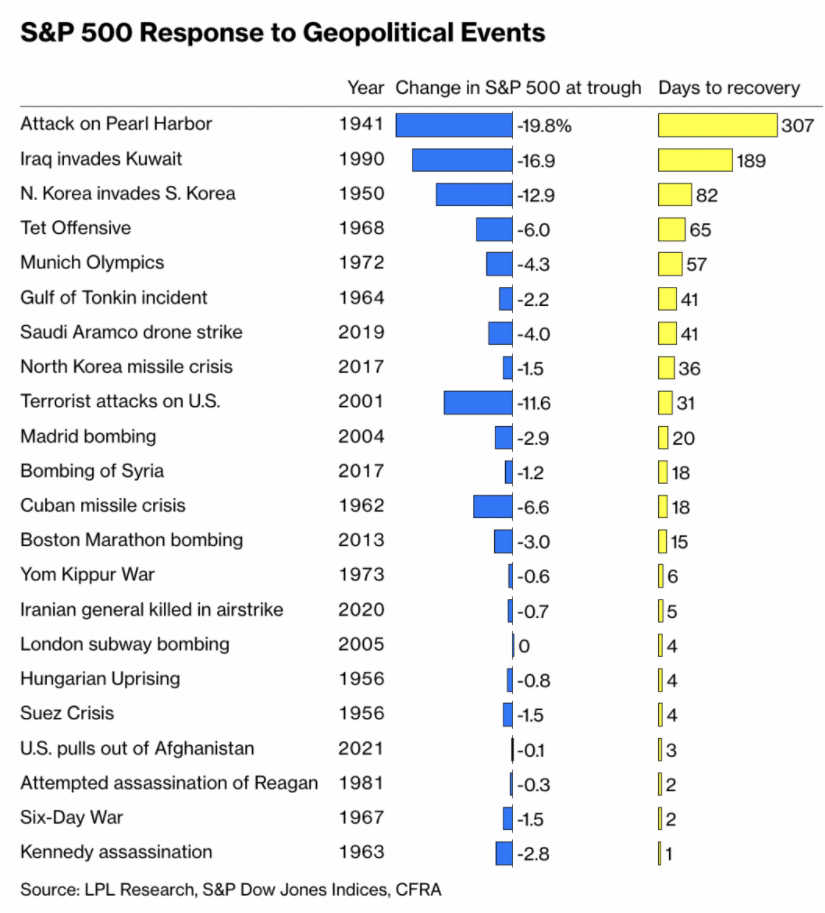

By way of illustration, if we observe some of the most significant geopolitical events on record over the last 70 years, on average*, the US sharemarket returned +5% in the 6 months following these crises and +9% in the 12 months after the events shown below.

*Note – Dow Jones Industrial Average (1963), S&P500 Index (1964 – 2021)

If we consider the impact of Geopolitical events from the perspective of the time taken for markets to recover from the initial shock, we can also observe that markets are incredibly resilient in the 12 month period thereafter.

Whilst it may not be always highly intuitive to accept that markets can remain positive in the face of such turmoil, it is important to keep in mind that there are many factors that contribute towards the growth of company earnings, some of which will relate directly to the geopolitical events of the time, many of which however will relate more to the broader issues relevant in the economy.

More than anything, such events remind us that the only way to mitigate against the risk of unknown future events in financial markets is to diversify as broadly as possible across asset classes, geographic regions, sectors, and securities.

Let’s hope and pray in the coming weeks and months that peace can prevail, for the sake of all humankind.

This material is provided for information only.

No account has been taken of the objectives, financial situation, or needs of any person. Accordingly, investors should, before acting on the information provided, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation, and needs.