Mixed Messages: Bond and Equity Markets are Sending Different Messages

Since the beginning of 2023 equity and bond markets seem to be on two different paths. Equity markets, which by their nature are optimistic, have been rising despite the continuing increase in interest rates by central banks. Bond markets, which by their nature are pessimistic, have been pointing to a dramatic slowdown in the economy. How should investors interpret these mixed messages, and what can they do about them?

Fears are growing about the strength of the economy here in Australia after the 12th increase in interest rates on June the 6th that have taken the cash rate to 4.1% – and the RBA said further rate increases could be necessary to tame inflation. The bond market is signalling a looming recession. The sharemarket, in contrast, has been steadily rising since October last year, both here and in other developed markets. Are equity markets ignoring the signs that a global recession is around the corner? Or have bond markets got it wrong and economies will slow into a gentle soft landing rather than a recessionary hard landing?

Stock Markets Have Been Rallying

Let’s look at equity markets first. The chart here shows the rise – albeit uneven – of the Australian stock market, represented by the S&P/ASX 200 index since the start of the year. It’s up by 4.4% year to date (to the end of May). Not bad given that this year alone interest rates have gone from 3.1% at the end of December to the most recent rate increase just announced on June 6th of 25 bps, taking Australia’s cash rate to 4.1% – its highest level since April 2012.

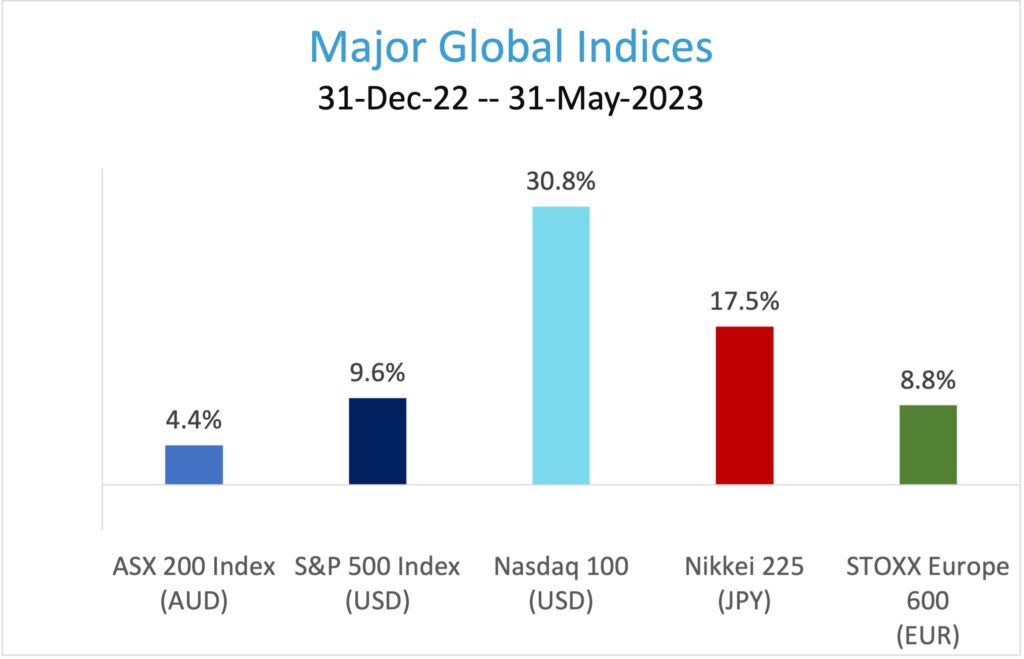

But international markets are doing even better. The chart below shows some of the major indices around the world in their local currency. The US and Euro zone are both up 9.6% and 8.8% respectively, and even the Nikkei – the benchmark for Japanese equities – is up over 17%. Most strikingly the Nasdaq index – home of the high tech stocks – is up an extraordinary 30.8% year to date.

Now we do have to put this in context. Last year the S&P 500 index was down 18%, the Euro market was down 10%, and the Nasdaq really had a bear of a year and was down by over 32%. The Australian stock market maybe lagging a little this year, but last year it was down by a modest -1.1%. So we are pretty much back to where we were when markets were at their peak at the end of 2021.

What is Driving Equity Markets?

The US Sharemarket has been rising despite the background noise around the debt ceiling, the recent spate of regional bank collapses in the US and concerns that there might yet be more. It has been helped by a better-than-expected corporate earnings season and by a conviction within the markets that the interest rate cycle, if not over, is at worst one final 25 basis point increase away from the end.

More surprising is that the more rate-sensitive technology stocks in the Nasdaq are doing so well. An explanation here might be that the tech sector is being powered by Artificial Intelligence (AI). The release of ChatGPT has kicked off a wave of enthusiasm about AI that has manifested itself as an almighty boom in the valuation of tech companies.

How much of the rally is explained by AI enthusiasm? About a fifth of the rally is due to Nvidia alone – a company that few would have heard of only a few months ago – whose shares are up 170% year to date. As well, Apple and Microsoft, the top two US companies by market value, have both climbed nearly 40 per cent. These stocks and a handful of other mega-cap stocks have accounted for 88% of the S&P 500 gains year to date.

But the rise in markets around the world is supported from more than just the concentrated rally in Big Tech. In the US consumer discretionary stocks – which to be fair does include names like Amazon and Tesla – is outpacing consumer staples (think Walmart, Proctor and Gamble for example) by more than 20%. In Australia discretionary spending (Aristocrat, Flight Centre, etc.) is outpacing consumer staples (Woolworths, Coles), although by a more modest 1.8%. Typically, when consumers lose confidence in the economy you would expect the reverse, that defensive stocks would do better than discretionary stocks.

Inflation Is Coming Down and the Terminal Rate is Close

Now it is true that inflation is cooling. Earlier in May the headline rate for US inflation fell below 5 per cent from a peak of around 8.5%, and in Australia the headline rate of CPI for April came in at 4.9 per cent, easing below 5 per cent for the first time in two years and continuing 10 straight months of declines. However, inflation is still quite some ways from the target band of 2% – 3% that central banks are aiming for, and while it is moving in the right direction it is not coming down fast enough. The RBA has noted that some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe.

There are two scenarios here: On one hand, there is the view that central banks are very close to the “terminal rate” for this cycle, and inflation will continue to cool bringing the economy into a soft landing. On the other hand, the central banks may have already pushed up rates too far and the economy is heading for a recession. The equity market seems to be of the former view, but the bond market is of the latter.

The Bond Market is Signalling Recession Ahead

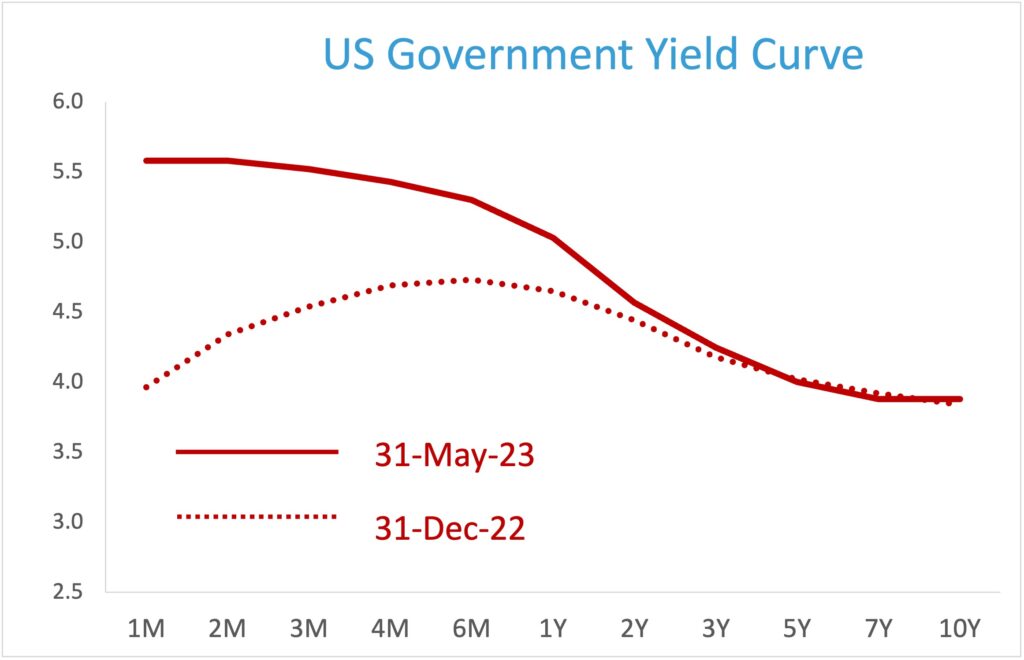

The mood in bond markets has decidedly turned negative and many economists are saying that a hard landing is now inevitable. A way to look at how the bond market sees the world is by looking at the yield curve – the yields on government bonds of different maturities at a point in time. The below chart shows the US yield curve as it looked at the start of the year, and how it looks at the end of May.

A way to interpret this curve is that back in December the bond market was predicting that there would be a few more rate rises in the first 6 months of the year, which would push the economy into recession and interest rate cuts would follow. Now at the end of May the yield curve is indicating that we are already there – rates are much higher at 5.25% than they were expecting at the start of the year, and the next move from here will be down.

The yield curve is steeply inverted – short-term yields are significantly higher than those on longer-dated securities. That inversion might signal an expectation of a US recession, as every recent recession has been preceded by an inversion in bond yield. Bond markets are not sending a reassuring signal for the economy.

It appears that the stock market is pricing in a soft landing, while the bond market is pricing in a hard landing. As investors what are we to make of this? Which side do we want to be on?

What should investors do with these mixed messages?

Are we about to head into a recession, with the inevitable increase in unemployment and business closures that comes with that, or are we in the middle of a bull market in shares that will ignore a slowing economy and continue as interest rates start to come back down? There are a couple of points to keep in mind when reading these mixed messages.

- The bond market is no better at predicting the future than the equity market. You only have to go back to the start of 2021 when yield curves were predicting that interest rates in 2- or 3-years’ time would not be higher than 2% to see how wrong their predictions can be.

- The equity market may have priced in the economic slowdown and its effects on specific company earnings already, in which case a recession will not be a surprise. The yield curve has been inverted since June last year, so if there is a recession it will be the most anticipated one ever.

Conflicting narratives will always tempt investors to chase market movements. On the one hand the prospect of a soft-landing supports the equity market. On the other hand, the risk of recession suggests adding government bonds as a safe haven asset and reducing credit exposures.

Markets are likely to be volatile as these narratives resolve themselves into an actual outcome. The best strategy in these circumstances is to have a well-diversified portfolio across countries and asset classes.

A diversified equity exposure across Australia and global markets will ensure that investors capturing the upside of unexpected sectors – such as AI-related stocks – as well as unexpected country returns – such as the Japanese market. And in fixed interest an allocation across government and corporate (credit) bonds will protect the portfolio if equities do stumble, as well as providing capital appreciation when interest rates do inevitably start to come down again.

Staying disciplined and sticking with the portfolio that was designed to meet your goals is the best way to navigate the mixed messages from financial markets.