The role for Bonds in a Portfolio | Inflation & Rising interest rates

Central Banks have pushed interest rates close to zero and bought trillions of dollars of bonds to support their economies and underpin extensive Government borrowing programs throughout the pandemic. This inevitably raises questions and concerns about what will happen when those policies are ultimately reversed.

Fuelling the concern is the marked uptick in headline inflation in many developed countries as a historically large degree of monetary and fiscal stimulus feeds into economies recovering from the initial shock of COVID-19. Similarly, much of the largesse has found its way into significant increases in financial asset prices around the globe.

There is considerable debate and uncertainty about whether the recent inflation spike is merely transitory or more entrenched, and of course the answer will determine the next move made by the US Federal Reserve and other Central Banks around the world.

In this environment, a common fear is that rising interest rates may create a negative environment for bonds, prompting investors to shift from longer-dated maturities to the perceived safety of shorter term securities, or even cash.

APW believes these responses betray simplistic assumptions about the link between official cash rates, (set by Central Banks) and bond prices, the principal role of bonds in a globally diversified portfolio and the opportunities generated by holding securities with varying maturities, credit and currency – whatever the climate.

In this article, we review the critical and fundamental roles of bonds in a diversified portfolio; the historical relationship between inflation, interest rates and bond performance; and the importance of resisting knee-jerk reactions to short term market noise.

Bond Basics

Bonds play a number of important roles in a diversified portfolio, irrespective of the stage of the interest rate cycle, which naturally vary in emphasis and depend on individual risk preferences, goals, circumstances and broader portfolio objectives.

Among the key reasons for holding bonds are, to provide both capital growth and income, to preserve capital, to protect against inflation, and to offer liquidity. Above all of these reasons however, the most important role of Bonds is to act as a source of stability to offset the much greater volatility inherent in the growth component of portfolios – particularly that of equities (i.e. shares).

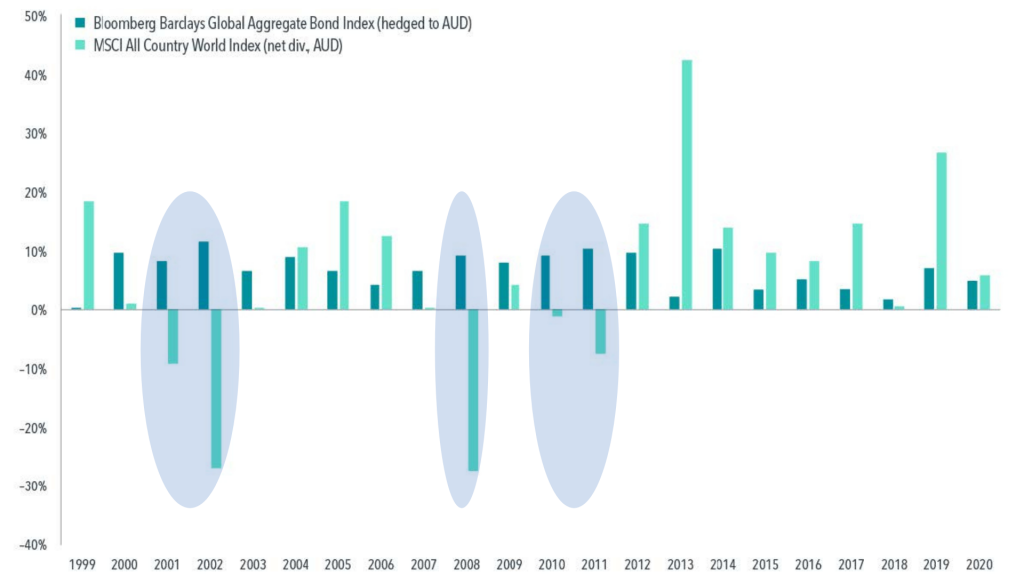

To help illustrate this key function of bonds, Figures 1 and 2 below show the calendar year returns of both the Australian and Global Developed equity markets, relative to the movements of the respective bond markets from 1990 through to the end of 2020.

As can be seen in years where Global equity markets experienced declines (lighter bars) – including 2001-2002, 2008, and to a lesser extent 2010-2011 – Global bonds (darker bars) steadied the ship with positive returns, offering greater resilience for broadly diversified portfolios and providing optionality for portfolio rebalancing and satisfying liquidity requirements.

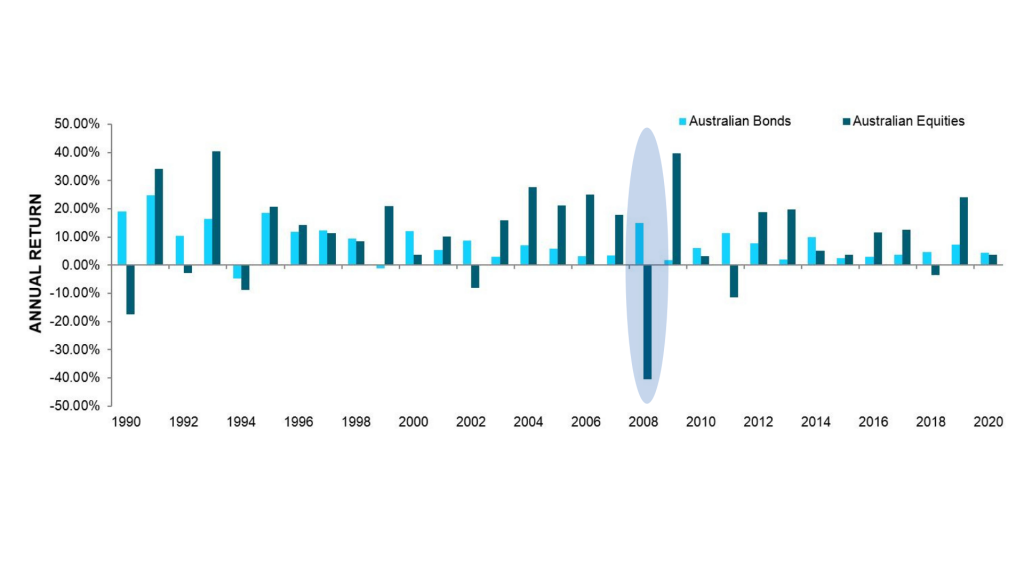

Similarly to the returns in Global markets above, Figure 2 shows that in years when Australian equities were negative – including 1990, 1992, 1994, 2002, 2008 (GFC), and 2011 – bonds provided relatively positive returns.

Figure 2: Australian Equity and Bond Market | 1 January 1990 – 31 December 2020.

Returns are in AUD. Australian Bonds are represented by the Bloomberg AusBond Composite 0+ Yr Index and Australian Equities are represented by the S&P/ASX All Ordinaries Index (Total Return). S&P/ASX data reproduced with the permission of S&P Index Services Australia. Data provided by Bloomberg Finance L.P.

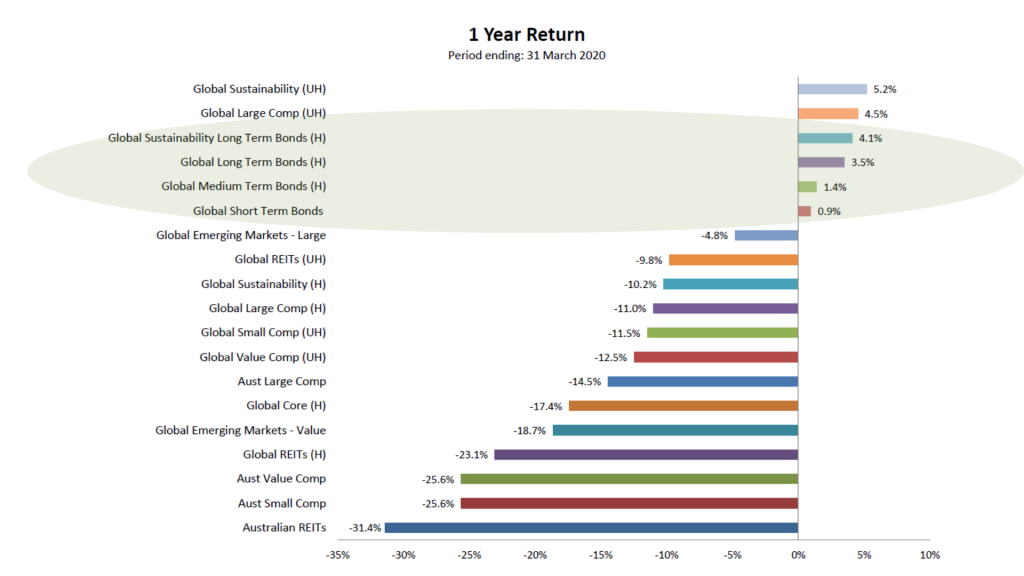

More recently, we witnessed in rather dramatic terms – the stabilising impact that bonds can provide to portfolios (see Figure 3). During the initial shock of the COVID-19 pandemic in March 2020, equity markets fell by between -30% to -40% in under a month.

During this period, bonds did exactly what they were supposed to do – softening the blow of the sharp decline in growth assets.

Inflation, Interest Rates and Bonds

Like share markets, bond markets are also forward-looking, with expectations for inflation, future interest rates and economic growth already reflected in current prices. This fundamental concept is a critical one for investors to recognise, as it is far too simplistic to think or say ‘markets will do ‘X’ due to the next upward move in interest rates’, when markets already price in such an expectation.

Even when interest rates are at zero, it isn’t assured that the next move must be upward. Indeed, there is already evidence of the somewhat perverse concept of ‘negative interest rates’ in some parts of the world in recent years.

As another example – in March 2021 when US inflation numbers spiked, bond investors took fright on expectations the Federal Reserve would start increasing interest rates earlier than previously anticipated.

However after longer term bond prices fell in early 2021 they quickly regained most of the decline in the subsequent months as the US Federal Reserve bank re-affirmed that they would treat the inflation spike as transitory and not a sign of a permanent shift.

In other words, asset prices changed in response to new information.

For those that believe markets are not efficient at pricing in future expectations, there are tactical asset allocation strategies that trade on speculation about future interest rate movements. However, unsurprisingly these have a very poor record, partly due to the fact that to be right, it is necessary to consistently outguess the combined wisdom of millions of market participants operating around the clock in globally interconnected markets, and also cover the cost of management and transaction costs to do so profitably.

Trying to second guess prices and shift portfolio holdings in response to news already reflected in prices is not only unwise, but detrimental to wealth creation and preservation. More importantly, it is completely unnecessary.

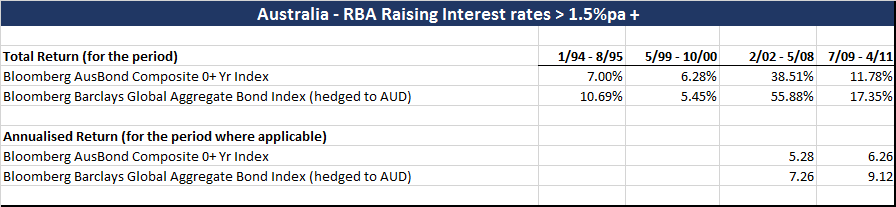

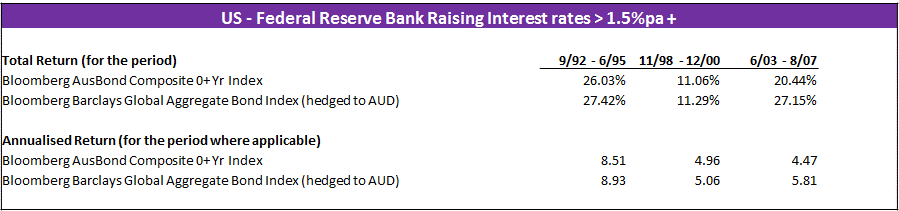

To further emphasise this let’s look now at historical periods of rising official interest rates, to challenge the assumption that holding bonds, (particularly those with longer dated maturities), should be avoided in such periods.

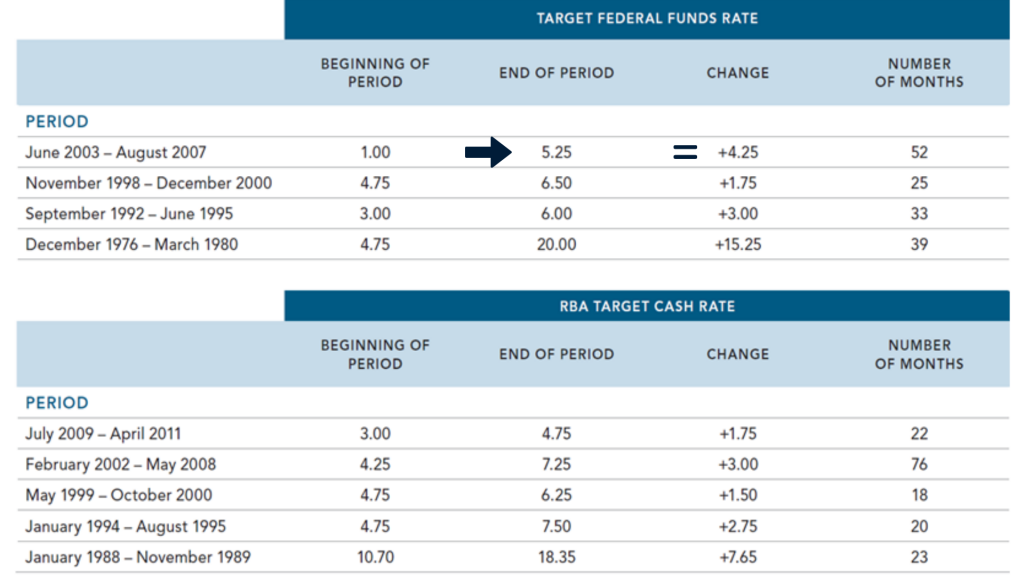

Figure 4 shows periods of significant rises in official interest rates in the US (from 1976) and Australia (going back to 1988). The table shows where rates were at the beginning and end of the period, and the overall change for each period.

Figure 4: Periods of Significant Change in Interest Rates (US & Australia)

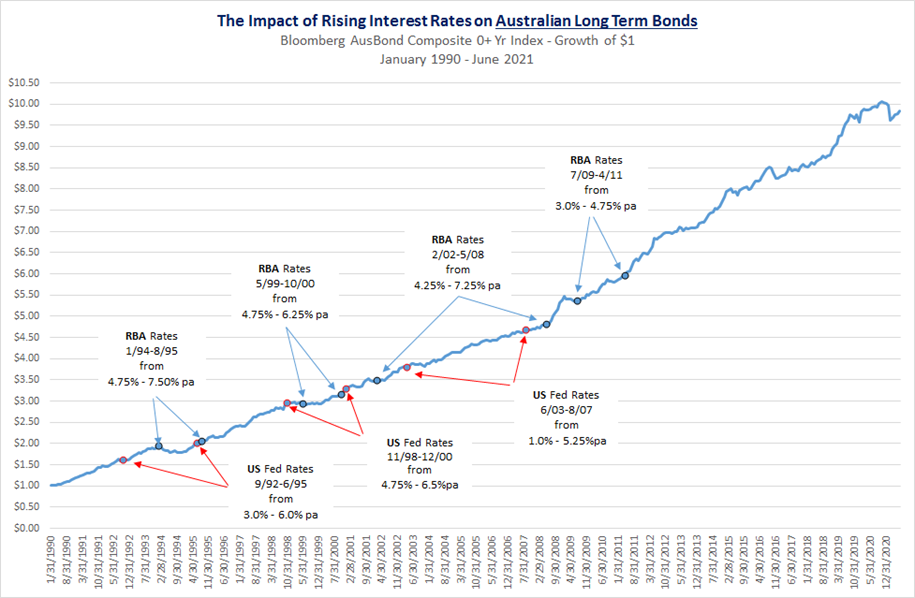

Figure 5 below shows what happened to Australian long-term bonds in the upward RBA and Federal Reserve rate cycles highlighted in Table 1 above, over the past 30 years or so. The below chart shows there was a positive bond return in all those periods, irrespective of what happened to cash rates.

Importantly these are Australian bonds. What about Global bonds?

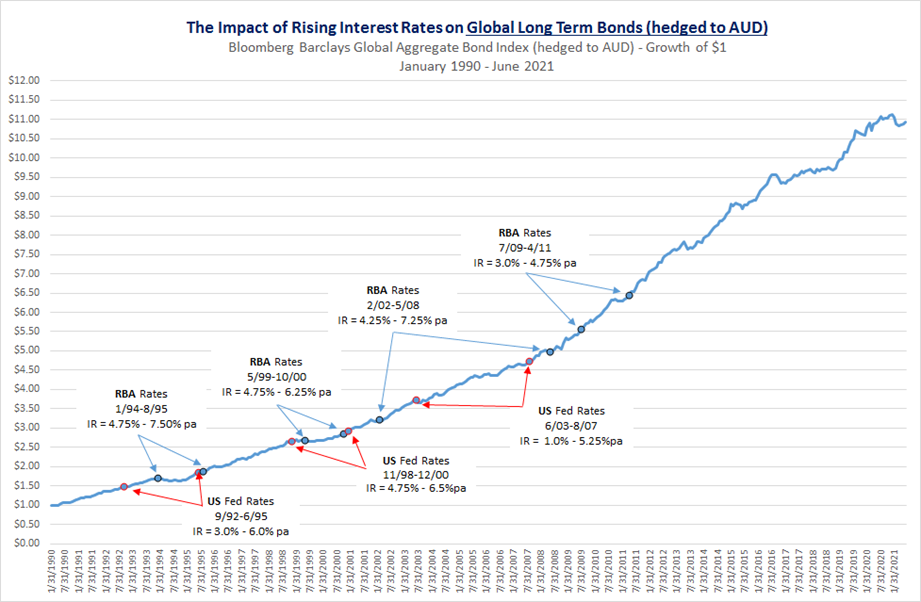

In the following two charts, we run similar observations for global long-term bonds, hedged to the Australian dollar, over the same period from 1990 to the present.

Again, we see very solid positive returns from global bonds, as measured by the Bloomberg Barclays Global Aggregate Bond Index, irrespective of the interest rate cycles of the Australian and US central banks.

If you think about it, these results should not really come as a great surprise.

Just like Equity markets reflect the forward expectations of company earnings and profitability, Bond markets tend to move ahead of Central Banks, as they react to new information on inflation, economic growth and other variables such as supply and demand, in real time.

Of course, whilst there were incidents of rising interest rates over this period, these occurrences were vastly overshadowed by a secular downward trend in inflation and interest rates, which resulted in a multi-decade bond market rally.

Critics might assert that this trend is unlikely to be repeated in the coming decades and therefore the case for holding bonds is greatly diminished, but this misses the point that rising interest rates increase the coupon yield to bond investors upon reinvestment. Further, as outlined above, bonds continue to play a pivotal role in dampening the overall capital volatility in a well-diversified portfolio, incorporating bonds with variable maturity dates.

APW’s Approach

We have seen that bonds play a stabilising role in diversified portfolios in both up and downward interest rate cycles. In other words, the defensive role of fixed interest has not changed. And we do not expect it to change whatever happens with rates in the coming years.

More importantly, we have seen the folly of tactical changes in defensive allocations based on short-term news of inflation or interest rates, or the movements of individual bonds and markets.

The alternative approach, and the one we advocate at APW, is evidence-based. We apply today’s prices – the best estimate of future returns – to build highly diversified portfolios for clients based on their needs, not on economists’ dubious forecasts.

We believe, as the historical record shows, that prices very quickly accommodate new information. This state of constant change provides an abundance of opportunities to be flexible, – varying maturities, credit and currency exposure as appropriate.

When term spreads (the difference in expected return between long and short-dated bonds) are narrow, there is little reward for extending maturities, so we can hold shorter term bonds. But when terms are wider, there is correspondingly greater merit in holding longer dated bonds.

By remaining highly diversified and spreading our exposure across different currencies, we can reduce idiosyncratic risk related to one part of the market or to individual bonds.

Instead of short-term, knee-jerk reactions to information that is already built into prices, we can roll maturities and constantly reinvest across different markets as opportunities arise and according to the needs of each individual client.

This, we believe, is a disciplined, transparent and methodical approach which preserves the role of bonds as a source of stability, independently of the actions of Central Banks or the economic growth and inflation cycles.

Disclosure & Disclaimer

This material is provided for information only.

No account has been taken of the objectives, financial situation, or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation, and needs.

This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly. Any opinions expressed in this publication reflect our judgment at the date of publication and are subject to change.

Index data has been provided by MSCI, UBS, S&P/ASX, Bank of America/Merrill Lynch, Barclays, Citigroup and Russell Investment Group, and is subject to copyright. Indices are not available for direct investment. Importantly the reported performance does not reflect the expenses associated with the management of an actual portfolio.